Have you ever encountered the hassle of manual bank transfers or the high fees of credit card processing in your software application? Enter the world of ACH (Automated Clearing House) transfers, a method transforming how software platforms handle financial transactions.

With the integration of an ACH transfer API, you can offer direct, efficient bank transfers, enhancing user experience and reducing costs. But how exactly does this integration work, and what makes it so beneficial? Today’s article will discuss the essentials for software, highlighting everything you need to know to make an informed decision.

What Are ACH Payments?

ACH payments are the primary bank account payment method used in the United States, overseen by the regulator NACHA. At its core, the technology enables electronic transfers of funds between bank accounts, eliminating the need for paper checks or physical cash. These transactions occur through the ACH network, a highly secure and regulated system that facilitates the movement of funds between financial institutions.

Advantages For Business

1. Streamlined Operations

One of the primary benefits of ACH payment technology for businesses is the streamlining of operations. By automating payment processes, businesses can significantly reduce the time and resources required for manual transactions. This automation not only improves efficiency but also minimizes the risk of human error, ensuring accurate and timely payments.

2. Cost Savings

Traditional payment methods, such as paper checks, often incur substantial processing fees and administrative costs for businesses. In contrast, ACH payments typically involve lower transaction fees, making them a cost-effective solution for businesses of all sizes. Moreover, the elimination of paper-based processes reduces overhead expenses associated with printing, postage, and storage.

3. Enhanced Security

Security is paramount when it comes to financial transactions, and ACH payment technology prioritizes data protection and fraud prevention. Transactions conducted through the ACH network are encrypted and subject to stringent security protocols, safeguarding sensitive information from unauthorized access or manipulation.

This enhanced security provides peace of mind for businesses and their customers, fostering trust and confidence in the payment process.

4. Improved Cash Flow Management

Timely payments are essential for maintaining healthy cash flow, and ACH payment technology facilitates prompt settlements between businesses and their clients or suppliers.

With faster processing times compared to traditional payment methods, businesses can better manage their finances and allocate resources more effectively. This improved cash flow management lays the foundation for sustainable growth and financial stability.

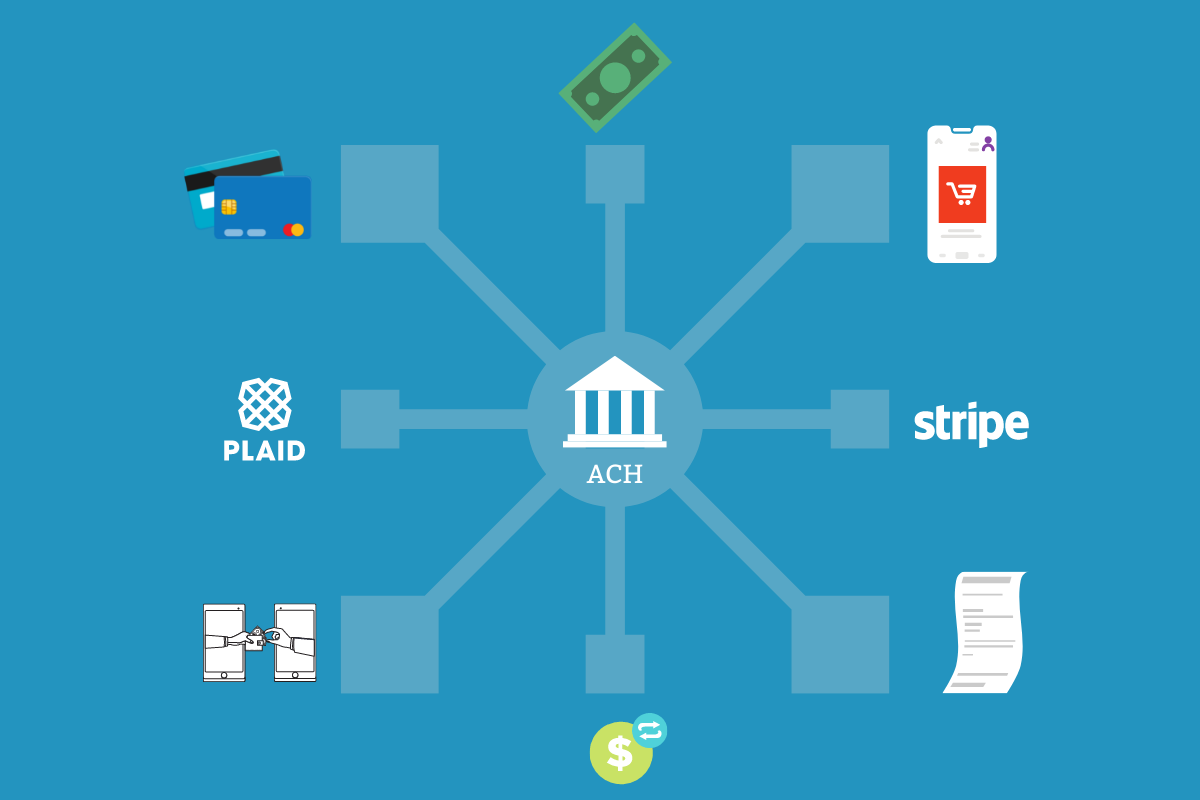

The Significance of ACH Transfers in Software

ACH transfers facilitate the electronic movement of money between bank accounts through the Automated Clearing House network, known for its reliability and efficiency. For software platforms, adding an ACH transfer API means giving end-users a smooth way to make payments or transfer funds right inside the app, avoiding slower and more complex traditional payment methods.

Here’s why integrating an ACH transfer API is more than just adding a feature; it’s about unlocking significant benefits:

- Enhanced User Experience: Provides a seamless and direct way for users to make payments, improving the overall experience.

- Cost-Effective Transactions: ACH transfers typically have lower fees than credit card transactions, making them a cost-effective alternative for both businesses and their customers.

- Increased Security: Leveraging the secure environment of the ACH network, these transfers reduce the risk of fraud and chargebacks.

- Streamlined Operations: Automates and simplifies the process of receiving and sending payments, reducing administrative workload and improving operational efficiency.

- Broad Accessibility: Connects your software to a vast network of banks, making it easier for users to make payments directly from their bank accounts without needing credit cards or third-party payment services.

- Future-Ready: Adapting to ACH payment technology prepares your platform for future financial innovations and regulatory changes, ensuring longevity and adaptability in a rapidly evolving digital payment landscape.

Diverse Applications of ACH Transfers in Software

The versatility of ACH transfer APIs extends across various types of software, from financial management systems to subscription-based services. Many software platforms and subscription-based businesses are starting to move away from credit card payments and diversify their payment options with things like bank account payments, buy now pay later, and digital wallets. Here are a few examples:

- Payroll Systems: Automating direct deposits to employees’ bank accounts.

- Marketplaces: Facilitating payments to sellers from buyers.

- Subscription Services: Managing recurring billing with ease and reliability.

Key Considerations for ACH API Integration

Expert integration of an ACH transfer API requires strategic planning and execution. The ACH network is government by NACHA, which takes care of most of the risk and regulatory considerations that businesses should be aware of. Aside from these factors, you should also think about the factors closer to your business model, and before you get started, consider these key factors:

- Choosing the Right Provider: Essential to success is selecting an ACH API provider that offers reliability, comprehensive documentation, and exemplary support.

- Security and Compliance: Ensuring the API meets rigorous security standards and complies with financial regulations is non-negotiable.

- User Experience: The API should enable a smooth, intuitive payment process within your software, minimizing user input while maximizing efficiency.

Step-by-Step Guide to Implementation

Implementing an ACH transfer API requires a clear plan and collaboration from development teams, product teams and management. Most integrations will span several weeks, and more complicated integrations could take a few months, so make sure you are aware of the scope of your development efforts. Here’s a breakdown of each step:

- Evaluation: Assess your software’s architecture to determine the best integration approach for the ACH transfer API.

- Development: Collaborate with your development team to embed the API, prioritizing a seamless user experience.

- Testing: Rigorous testing in a controlled environment is crucial to identify any potential issues before going live.

- Deployment: Launch the feature with confidence after thorough testing and be ready to provide support and make adjustments as needed.

Embracing the Future of Payments

In conclusion, integrating an ACH transfer API into your software doesn’t just upgrade your transaction capabilities – but propels you towards the forefront of payment innovation, where efficiency, security, and seamless user experiences are key.

Now is the perfect time to harness ACH technology. By doing so, you’re not just keeping pace; you’re setting the pace, paving the way for a future where your software leads in the digital payment revolution. Embrace this opportunity and get started today!