If you’re like most individuals, you’re not a professional trader. You don’t have the time or knowledge to trade manually, and you don’t want to put your money in danger based on a gut hunch. This is where automated trading systems may help.

You can make trades using automated trading platforms, often known as algorithmic trading, black-box trading, or bots. You only need to create an account and tell the software what you want it to accomplish. The software will then take care of the rest. If you are also looking forward to trying your hands at automated trading software, you are at the right place. In this article, we discuss some of the best-automated crypto trading software to use in 2024.

Top 5 Best Automated Crypto Trading Software

Below mentioned are some of the best automated crypto trading software:

1. Fast Profit

It is an amazing cryptocurrency analytics platform that provides traders with in-depth market data. With the help of fastprofit fastprofit, crypto traders may devise market-beating strategies and identify profitable investment opportunities.

This analytics tool encourages users to create amazing trading strategies. It provides its users with various indicators and analytical tools for this purpose. The software also enables users to backtest trading strategies under real-time market conditions, enabling them to assess whether or not their strategy would be profitable.

If traders dislike designing their own strategy, they can rely on this tool’s crypto trading signals. This will include important details such as entry prices, take-profit/stop-loss levels, and the sort of trading order to use.

Pionex

Pionex is currently one of the best free bitcoin trading bots available. It offers not one but sixteen free built-in trading bots. Pionex enables its customers to automate trading by employing strategies like dollar cost averaging, arbitrage trading, and grid trading, among others.

Pionex operates as an independent trading platform that supports hundreds of cryptocurrency pairs. Another advantage of Pionex is that it permits leveraged trading. Users can purchase cryptocurrencies with credit cards and digital wager tokens to get additional platform perks. Moreover, this cryptocurrency trading bot is available as a mobile application, allowing investors to monitor their positions. Pionex charges no fees for the use of its bitcoin bots.

Coinrule

Coinrule was created to simplify bitcoin trading for investors. This trading bot permits users to develop strategies based on the ‘if-then’ logic. It is one of the most user-friendly crypto trading bots. It provides tutorials that guide people to creating an AI crypto trading bot. Consumers can connect their Coinrule accounts to their preferred cryptocurrency exchanges via APIs to get started.

Moreover, Coinrule integrates technical indicators like moving averages and the relative strength index (RSI), which can aid investors in building strategies. Additionally, the platform allows users to test their bot rules before deployment. Coinrule offers free as well as paid pricing choices.

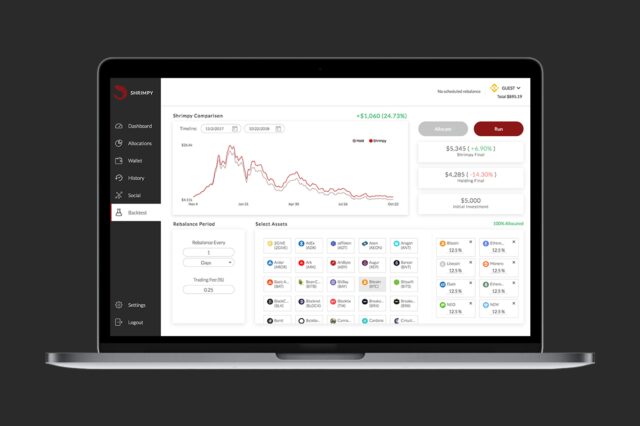

Shrimpy

Shrimpy is a one-stop shop for services related to bitcoin investments. It enables users to connect many cryptocurrency exchanges in a single location, facilitating the management of a comprehensive cryptocurrency portfolio. In addition, customers of Shrimpy will be able to track the performance of their investments and monitor the market via a single portal.

This platform also integrates cryptocurrency robot trading, allowing users to create an intuitive way for portfolio rebalancing. In this manner, Shrimpy aids investors in mitigating portfolio risk by market conditions. Investors can also use the backtesting feature to examine their trading strategies before risking capital.

3Commas

3Commas offers cryptocurrency trading bots that are compatible with over 18 exchanges. Users can trade manually or configure a cryptocurrency bot. Users of 3Commas can employ automated trading methods for multiple crypto pairings simultaneously. Moreover, 3Commas’ trading bots can use TradingView indications such as the RSI and ULT to make trades. Additionally, the website provides bots that can imitate the techniques of other traders. 3Commas is perfect for experienced crypto traders acquainted with bot trading cryptocurrencies. Also, it has a free trial version that you can use to check whether the tool fits your needs.

How To Use Automated Cryptocurrency Trading Platforms

Automated platforms for trading cryptocurrencies can be incredibly handy for investing and trading in digital currencies. Here are some suggestions for using them.

1. Conduct Proper Research

Before employing an automated crypto trading platform, studying and comprehending how they operate is essential. This involves being aware of the platform’s fees and hazards.

2. Create A Test Account

Most platforms include a demo account, which is an excellent method for becoming acquainted with the platform and its capabilities. It is also advisable to test the automated trading tools of the platform before using them with real money.

3. Create An Account

Once you have completed your research and are prepared to trade, you must create an account on the site. Typically, this requires submitting personal information and financing the account with fiat currency or cryptocurrency.

4. Commence Trading

After establishing and funding your account, you can begin trading. If you are not always accessible to trade manually, most platforms allow you to build automated trading methods, which can be handy.

5. Monitor Your Account Activity

Regular account and trade monitoring are essential, especially if you use automatic trading features. Thus, you can identify possible problems and take remedial action as necessary.

Conclusion

There are numerous advantages to employing an automated trading platform. For starters, it removes emotion from trading. When you trade manually, allowing your emotions to influence your decisions is simple. Fear, greed, and hope can all influence poor judgments.

Also, automated trading systems can execute trades more quickly and efficiently than you can. They can also make orders for you automatically, which is useful if you trade in a volatile market. Moreover, bots can perform backtesting for you. You may run a trading strategy against historical data to see how it would have fared. Use one from the above mentioned options to enjoy an amazing trading experience.