You might have heard about the significance of having an insurance certificate if you’re an entrepreneur or freelancer.

A certificate of insurance proves that you have liability insurance in case of mishaps, property damage, or other liabilities.

But one significant query many folks have is: how much does a certificate of insurance cost? In this article, we’ll look at how much a certificate of insurance typically costs and how various factors can affect that cost.

What Is A Certificate of Insurance?

It demonstrates the existence of insurance coverage. An insurance provider or broker often presents it to a third party, such as a buyer, seller, landlord, or state agency, to demonstrate your insurance. Usually, the following details are listed on the insurance certificate:

- Name and address of the insured

- Type of insurance coverage

- Policy number and limits

- Effective and expiration dates

- Name and address of the insurance company

- Name and address of the certificate holder

- Description of operations or services

Factors That Impact Certificate of Insurance Cost

Numerous factors can affect how much a certificate of insurance costs. The most frequent elements that can affect the price are as follows:

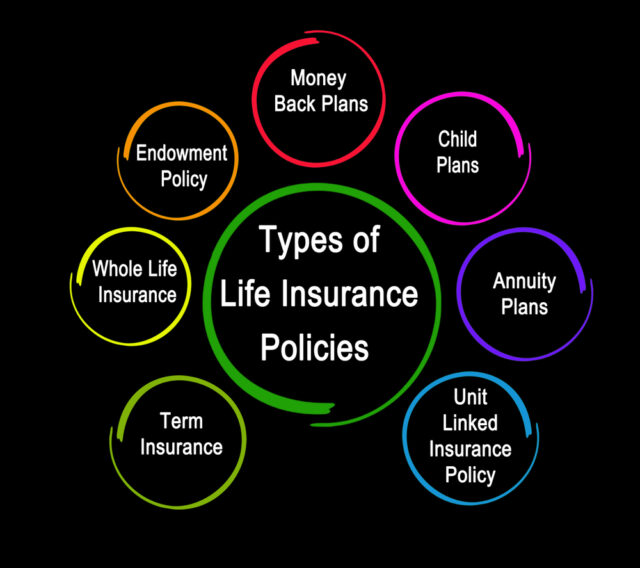

Type of Insurance Policy

The type of insurance coverage greatly influences the price of a Certificate of Insurance(COI). COIs are records that attest to an organization’s insurance coverage and are frequently needed before starting a project or signing a contract. The three main types of COIs are general liability, workers’ compensation, and auto liability. The coverage amounts for these policies can vary, with some policies, like general liability, having higher coverage amounts than others, like auto liability.

Duration of Coverage

The duration of coverage selected will also affect the cost of a COI. Short-term policies will typically have lower COI costs than long-term policies.

Coverage Limits

Coverage limits refer to the maximum amount an insurance company will pay for a claim. Higher coverage limits mean higher premiums and, consequently, a higher cost for the COI.

Deductibles

Deductibles are the sums a covered individual or business must incur before their insurance policy starts to pay benefits. Higher deductibles equate to lower premiums, which lowers the COI’s cost.

Industry Risk

The level of risk associated with a particular industry affects the cost of insurance policies, including COIs. For example, industries with a higher risk of injury or property damage may have higher insurance premiums.

Business Location

A company’s location also influences costs for insurance policies. The insurance coverage price may change depending on which areas are more likely to experience theft, natural catastrophes, or other problems.

Business Size

The size of a business also affects the cost of insurance policies. Larger businesses may require higher coverage limits, resulting in higher premiums.

Claims History

Claim history can impact the price of a certificate of insurance. Insurance companies assess your risk level and potential for future claim filings based on your past claims. Your claims history includes the specifics of any claims you’ve made, including the circumstances surrounding the damage, the insurer’s settlement amount, and other pertinent details. The risk of covering you is evaluated by insurance companies using this data, which is then used to calculate your premium and deductible costs. Knowing how claims you start can affect your claims history and premium rates in the long term is important.

Why Do You Need A Certificate of Insurance?

Third parties want a certificate of insurance to protect themselves from potential liability resulting from your professional or business conduct. Consider the scenario where you are a contractor contracted to renovate a client’s home.

The customer can then request a certificate of insurance to validate your liability and workers’ compensation coverage in case of an incident or injury. The retailer may also request a certificate of insurance from a seller of products to a store to verify that the goods are protected against product liability claims. You can work or transact with clients or associates with an insurance certificate.

How Much Does A Certificate of Insurance Cost?

The cost of it depends on several factors, including the kind and scope of insurance protection, the policy duration, the percentage of certificate holders, and the issuing firm or broker.

The good thing is that a certificate of insurance is often provided to the insured without additional charge because it is considered a standard insurance policy provision. The cost of the insurance certificate is typically included in the premium or charge that the insurance company or broker pays for the policy. As a result, if you currently have insurance coverage, you can obtain a certificate of insurance without paying any additional fees.

However, the insurance provider or broker may charge a fee if you need a certificate of insurance for a one-time employment or a short-term contract. The fee could be as little as $20 per month or as much as $200, depending on the complexity of the request and the necessary turnaround time. Some companies could charge a processing fee for every extra insurance certificate supplied to various certificate holders.

How To Obtain A Certificate of Insurance?

Please consult your insurance company or broker and present them with the certificate holder’s information and the required paperwork to obtain a certificate of insurance. The insurance company or agency will issue the certificate of insurance after verifying your insurance coverage, often within a few business days. Based on the service choices offered by your insurance provider, you can contact them to ask for a certificate of insurance via telephone, email, or website.

Summary

A certificate of insurance is a critical document attesting to the insurance coverage of your business, work, or enterprise. The price of a certificate of insurance may vary according to the context. Still, it is often sent to the insured at no additional cost since the insurance policy subscription covers it. It’s crucial to obtain a certificate of insurance when requested by third parties to provide proper insurance protection. Consult your insurance agent or broker for help if you require a certificate of insurance.