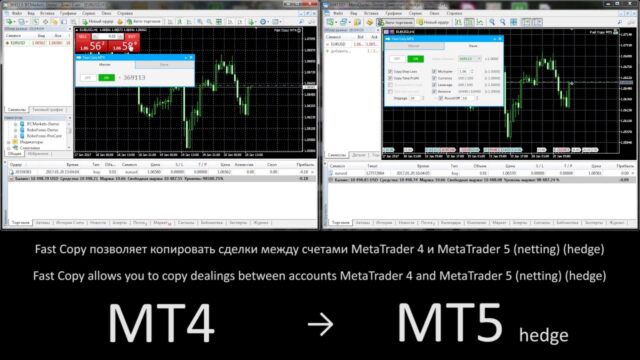

In the last 20 years, trading platforms have gone from simple to complex, from unsophisticated to highly developed, and from slow to lightning fast. With the advent of MT4, or MetaTrader 4, in 2004, everything changed. Traders had access to an agile platform they could download or use through their broker’s web portal. At that time, it was mainly for forex but now offers the capability to trade virtually any instrument in existence.

Five years after MT4 made its debut, MetaQuotes Software Corp. released MT5, which was aimed at the non-forex market at that time. Since then, the two platforms have been adopted by individuals and brokers, many of whom offer it as an add-on for their own customers. Of course, there are hundreds of other trading platforms out there, some similar to MT4 and MT5, and others not. The larger online brokers all offer their own platforms, which many of their clients use. If one thing defines the current situation for individual traders, it’s the huge number of choices they have after they choose a brokerage. Anyone who intends to trade, or who currently has an online account and uses it regularly, should know the following facts about the evolution of brokerage platforms.

MT4 and MT5 are Market Leaders

By today’s standards, the 2005 version of MT4 would be considered primitive. For one thing, it was designed for forex only and didn’t acquire the capacity to do anything else until later. Even MT5, which was much more advanced and agile at its debut in 2010, has grown into a powerful tool for anyone who wants to trade just about anything.

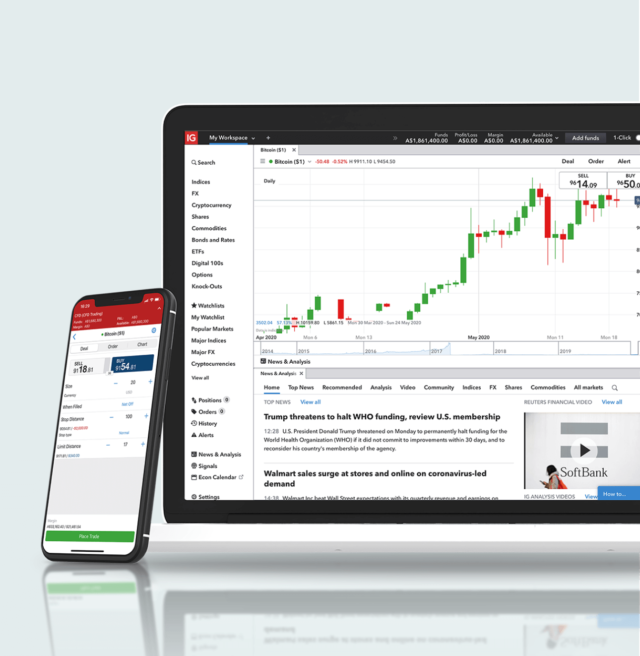

Individuals can download the trader-side version of either platform onto their PC’s, laptops, phones, or other devices. Many firms offer it as an add-on or a web-based utility for customers who wish to use it. There’s no need to download it if your broker offers a web-based version, but having your own copy of the software on your devices lets you analyze, study, do research, and conduct backtesting anytime and anywhere you wish, without logging into the broker’s website. While MT4 and MT5 are market leaders with many millions of users, there is plenty of competition from other software companies and from proprietary trading systems available on companies’ own websites. In some cases, those web-based utilities are tweaked versions of MT4 or MT5 for which the firm’s owner has paid a licensing fee.

Broker Platforms Offer Special Features

Firms who offer their own platforms do so for a number of reasons. Sometimes they choose not to pay for a license from one of the software developers and task their in-house tech teams with creating one. In other instances, they like to offer clients as many options as possible. That means letting customers choose among in-house proprietary systems, software for which the firm has paid a license fee, and using their own packages. Some of the in-house systems include special features developed for large groups of clients, like special charting or analysis capabilities.

Strategy Visualization Helps New and Experienced Users

Visualizing complex strategies, like options chains, for example, can be a complex chore for anyone who has ever tried to do it alone. Fortunately, modern software makes visualization easy. Whether someone decides to take on a series of tricky options or futures purchases or wants to see the possible outcomes of multiple forex price change scenarios, the best way to begin is with visualization. Early products, either stand-alone ones from retail developers or in-house versions, did not offer anything remotely similar to what today’s platforms can do.

User Experience and User Interface are the Best in the Industry

Firms have an incentive to make the user experience excellent. They’ve done exactly that and it’s paid off. Most of the top five brokers’ platforms offer simple order placement, charting, account access, profit analysis, research capability, and more. Compared to other financial industry players, like banks, mortgage firms, and loan companies, all the top brokers earn high scores from consumers who use their sites.

Market Access Has Grown by Leaps and Bounds

Consumers have gradually upped their demand for market access. Nowadays, it’s common for a given software package to include access to dozens of markets, including forex, stocks, bonds, commodities, futures, options, ETF’s, CFDs, and others. Many people have no idea how many different kinds of financial instruments they can buy and sell, especially when they’re focused on a specialty or favorite niche, like forex or options. One of the latest entrants into the menu of offerings is cryptocurrency. In a few short years, most of the mainstream firms and software products have included crypto into the mix for any customer who wants to trade it. To know more about trade business visit Finscreener.

Users Demand Unique Functionality

No one who was active in the securities markets in the early 2000s could have imagined how quickly functionality would evolve. Capabilities for individual investors were initially limited to making only a few types of purchases, restricted use of limit and stop orders, no ability to hedge, and poor charting. Today’s financial consumers not only demand highly sophisticated functionality, but they also get it, and for little or no additional cost. Whether they opt for the firm’s proprietary software or use their own, advanced charting is just the tip of the iceberg. They can follow, in real-time, any number of transactions in multiple markets can transact business in almost any type of market, can use leverage in some accounts for certain transactions, and can read the latest news stories about any company that interests them.

Transaction Costs Have Gone Down

Some professionals used to charge flat-fee commissions on every trade, and a few still do. But in the early online days, those fees were much higher than they are now. In fact, four of the industry’s largest brokerage firms now charge zero commissions on standard trades. What does that mean for the average investor? It means they now have the ability to spend more of their money on buying and selling of securities, rather than on commissions. The widespread adoption of commission-free transactions is relatively new, so it remains to be seen whether it will be too much of an incentive for people to take more risks and over-trade within their accounts.