Have you ever wondered what “farming” means in real estate? Essentially, it is when a real estate investor buys a property and rents it out to generate income. It can be an excellent option for those looking for passive income and those who want to invest in real estate but don’t have the time or knowledge to manage a property themselves.

If this sounds like something that might interest you, keep reading for more information about real estate farming.

How Does Farming Work?

Farming usually works best when the investor buys a property in an area that is growing or is likely to grow. It could be due to new development, increasing population, or other factors. The idea is to buy low and sell high or keep the property and rent it out at a rate that covers the mortgage and generates a profit.

At Wise Pelican, we prepare the best postcards for real estate farming. We have a wide variety of design options to choose from, or we can create a custom design for you. We use high-quality materials so that your postcards will make a great impression on potential clients.

Different Types of Farming

There are a few different types of farming that investors can choose from, and each has its own set of challenges and rewards.

Traditional Farming

Traditional farming is the most common type and involves buying a property in an up-and-coming area to sell it for a profit when the market improves. It can be a risky strategy, as there is no guarantee that the market will indeed improve.

Rental Farming

Rental farming involves buying a property and renting it out long-term. The investor collects rent from the tenant and uses this to cover the mortgage, taxes, and other expenses associated with owning the property.

Any profit generated is pure profit, as the mortgage has already been paid off. It can be an excellent option for passive income, but it is important to carefully screen tenants to avoid any legal or financial problems down the road.

Flipping

Flipping is a strategy that combines elements of traditional and rental farming. The investor buys a property in an up-and-coming area to fix it and sell it for a profit. However, if the market doesn’t improve as expected, the investor can always rent out the property to generate income in the meantime.

What Are the Risks of Farming?

Of course, with any investment, there are risks involved. When it comes to farming, one of the most significant risks is that the area you’ve invested in may not experience the growth you were counting on. It could leave you stuck with a complex property to sell or rent out. Another risk is that the property could be damaged or vandalized, which would impact your bottom line.

There are several benefits to farming, including:

Potential for High Returns

Farming can be a great way to make a lot of money if everything goes according to plan. If you buy in an up-and-coming area and the market improves as expected, you could see a significant return on your investment.

Passive Income

When you rent out your property, you can generate a passive income stream that requires very little work. It can be a great way to make money without putting in a lot of effort.

Flexibility

Farming offers a lot of flexibility regarding how you want to operate. You can choose to buy and hold or buy and flip. You can also choose a traditional farm, rental farm, or flip. It allows you to tailor your investment strategy to your specific goals and needs.

Inflation Hedging

As the cost of living goes up, so does the rent you can charge your tenants. It will help you keep up with the rising cost of living and maintain your standard of living.

What Are the Challenges of Farming?

There are also some challenges associated with farming. These include:

High Upfront Costs

Buying a property is a significant investment, and it can take a long time to see a return on your investment. It’s especially true if you’re traditional farming, as you may have to wait years for the market to improve.

Tough Tenants

If you’re renting out your property, you may have to deal with difficult tenants. It includes late rent payments, damage to the property, and other problems. Screening tenants carefully can help reduce the chances of having difficult tenants, but there’s always a risk that you’ll end up with someone who causes problems.

How to Set Up a Farming Business

If you’re interested in starting a farming business, there are a few things you need to do.

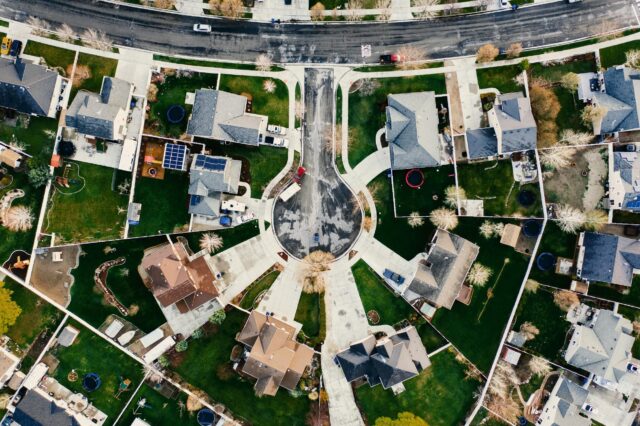

Choose an Area to Invest In

Choosing an area to invest in can be tricky, as you need to find an area that is growing or likely to grow in the future. You also need to have a good understanding of the local market to make informed decisions about which properties to buy.

Quantify the Market

Quantifying the market involves looking at things like population growth, job growth, median income, and other factors that will give you a good idea of whether or not the area is poised for growth. It will help you make better decisions about which properties to buy.

Create a Business Plan

Before you start buying properties, you need to create a business plan. It should include your goals, budget, and strategy for buying and selling properties.

Get Financing

You’ll need to get financing to buy properties. You can do this through a bank or private lender. When applying for a loan, be sure to have a solid business plan so that the lender knows you’re serious about your business.

Find the Right Properties

The right properties are those in up-and-coming areas and have the potential to appreciate value. You’ll need to do your research to find properties that fit this criterion.

Get the Right Insurance

Farming can be a risky business, so it’s essential to have the right insurance. It will protect you financially if something goes wrong. Moreover, it will give you peace of mind knowing that you’re covered in case of an emergency.

To Sum It Up

Farming can be a great way to make money in real estate, but it’s essential to understand the risks involved. If you’re careful and do your research, you can find great opportunities to help you achieve your financial goals. When done correctly, real estate farming can be a very lucrative investment strategy.