You must invest consciously and follow some basic guidelines if you want to survive the incredibly volatile and heavily managed crypto market.

In this article, we’ll go over eight easy but important crypto investment rules that will help you develop your investment strategy with every passing day.

If you follow these principles, you will not only be able to survive the crypto market, but you will also be a profitable investor who is immune to costly blunders.

1. Learn About Cryptocurrency

You should understand how cryptocurrencies work before investing in them. Cryptocurrency trading prices, unlike traditional fiat currency, are purely determined by market demand and supply. This means that as demand for a crypto-currency rises, the rate rises in tandem. This is due to the fact that the number of cryptocurrencies is quite limited.

As a result, you should research how different cryptocurrencies have performed over the last two to three years. Learn when and why their rates rose or fell and the highest and lowest rates reported over three months. Regarding investing in cryptocurrencies, such research will provide near-perfect insight into when to purchase or sell.

2. Find A Reliable Crypto Exchange

Finding the finest crypto trading exchange is only half the battle. Hundreds of online crypto trading exchanges provide cryptocurrency and forex trading. However, you should not choose the first crypto trading exchange you discover online.

The finest crypto trading exchange is honest and trustworthy. Remember that your money is on the line; therefore, you’ll want to know that you can trust your crypto trading exchange. Check to see if your crypto trading exchange is regulated. This is the most reliable and thorough technique to ensure that they are trustworthy. The regulated crypto trading exchange also provides the finest digital security measures, the best execution pricing, and outstanding customer service if and when needed.

Start your cryptocurrency investment journey at https://bitqs.online/.

3. Begin Small And Work Your Way Up

The important rule in any investor’s book is to reduce risk, which means learning the market before placing a large wager for a beginner. If you haven’t read the disclaimers and skimmed through the text, you are well aware of how unpredictable the crypto market can be. On a bad day, you may quickly lose the majority of your money. As a result, it is critical not to succumb to market sentiments and begin trading with tiny sums that you are comfortable losing. You can never lose more than you put in, so don’t risk more than you can afford to lose, and you’ll be fine, even in the worst-case scenario.

4. Avoid Emotions

As an investor, the much-discussed “emotions” are harmful. If you invest in cryptocurrencies based on your emotions, you’ve probably made a mistake. FUD stands for “fear, uncertainty, and doubt,” as you may have heard. These are the three most typical emotions you might have as a cryptocurrency investor.

As humans, we get enthusiastic, frightened, and desperate, but we must attempt to avoid these feelings when it comes to crypto investment. So there’s no need to rush. Make sensible decisions after analyzing the market. Allowing your emotions to dictate decisions for you is not a good idea.

5. Avoid FOMO

The term “FOMO” refers to the fear of missing out, which occurs when we believe that others are having a good time while we are not present or absent. When the price of cryptocurrency climbs, and it appears like everyone is selling, FOMO kicks in, and you may feel compelled to sell because you are frightened of missing out.

FOMO sets in when you watch a cryptocurrency that you haven’t invested in gain in value. Then you sell your cryptocurrency to pay for it. So stay away from FOMO and keep your coin.

6. Invest For Long-Term

When Bitcoin was first introduced in 2009, few people believed in it. Despite this, they developed slowly, providing a fascinating history of value fluctuations. Those that invested in cryptocurrencies in the early days will undoubtedly have no regrets because they have only profited from their investment.

Cryptocurrencies are rising in popularity and respect, particularly since many banks and financial institutions have begun to offer bitcoin services. As a result, they are likely to appreciate value over time, therefore considering making long-term investments. This is referred regarded as HODLing, which is a slang term for “keeping” cryptocurrency. You will almost certainly be grateful in the future.

7. Diversify Your Crypto Portfolio

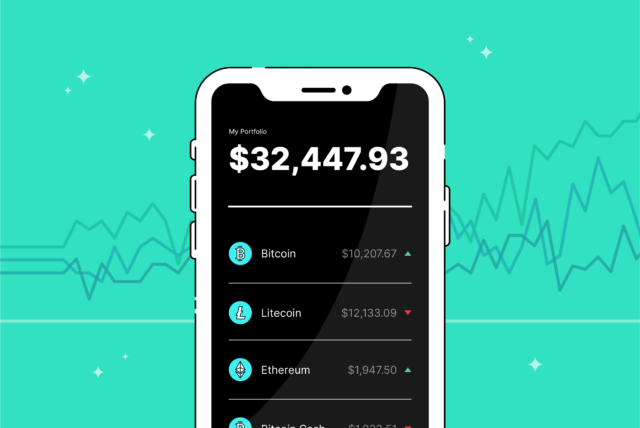

Make your investment portfolio more diverse. The most important piece of advice is to diversify your investments rather than investing all of your money in a single cryptocurrency. This will reduce your overall risk.

If you have a rudimentary understanding of statistics, you might attempt calculating the connection between the cryptocurrencies you want to invest in and then selecting those with a correlation coefficient that is as far away from 1 as possible, preferably negative. When the price trends of two digital currencies are similar, they are said to be correlated. For example, if the price of one cryptocurrency rises or falls, the price of the other will likely follow suit.

Regardless of whether the other digital currencies perform ineffectively, you will want to benefit if crypto in your wallet turns out to be amazingly famous over the long run and its price rises. Instead, if the currency has a bad run, the remainder of the portfolio will offset the losses. All significant investors use this method to reduce risk.

8. Learn From The Experts

In cryptocurrency, information is the most important factor. It’s new, and the abundance of flowing words can make people’s heads spin. As an investor, you will learn, tap into possibilities, and gain confidence in making mistakes. As a result, place a premium on expert advice. Their knowledge can help you avoid making the same mistakes they did. Crypto fans’ and experts’ maxims could be the ray of hope when everything else seems to be breaking apart.

Conclusion

The cryptocurrency market is fraught with danger. It’s steeped in potential volatility, and investing in crypto requires a set of guidelines.

Many bitcoin investment software programs make the process easier, but you also need to have a risk management strategy in place if you must invest.

As a novice investor or a seasoned trader, you must establish your principles and trade to profit. With the spectacular ascent of cryptocurrencies, the market has entered the mainstream, and it is a great opportunity.