Participating in any sort of trade is quite a complex thing. There are a plethora of elements that require your attention, and it is not always possible to maintain full control over your action on the market, no matter how efficient are tools you are using are. Not to mention that you cannot rely solely on using automated software without having your hand in it.

That’s why it is important to learn as much as possible about the craft of trading. Thankfully, there is a lot of literature and courses you can consult to obtain much-needed skills. You just need to invest some hard work and a lot of time. Learning to trade forex can be quite challenging for beginners.

Naturally, it is not possible to learn everything you need in a couple of hours. They may have a hard time making sense of trading terminologies like pips and spreads. These two types are crucial for achieving the highest possible results. At first, they might seem too complex to understand by a beginner, but this is not the case. Just arm yourself with patience. Here’s all you need to know about the two most basic concepts of forex trading:

What is a pip?

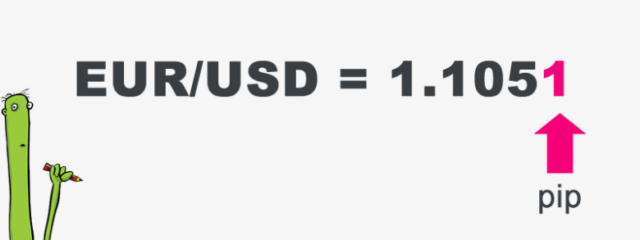

“Pip” stands for percentage in point or price interest point. It is the smallest whole unit price movement that an exchange rate can make in the forex market. Most currency pairs are quoted to five decimal places in forex, with the pip value at the fourth decimal place. While this may seem like an insignificant sum, experienced traders know that it is possible to take advantage of these small sums to win a significant sum.

Japanese yen-based pairs are an exception to this rule and are quoted to only three decimal places, with the pip value at the second decimal place. A pip is equivalent to one basis point or 1/100 of 1%. At the same time, practically all other currencies can fit right into this concept. So, you can see why we encourage every beginner to learn about a pip as much as possible before they start trading.

For example, the smallest whole unit movement that the USD/CAD pair can make is $0.0001. However, a currency pair with a Japanese yen would look slightly different, as one pip is equal to 0.01. If the exchange rate of the USD/JPY pair has a selling price of 109.315 and a buy price of 109.339, this would represent a 2.4 pip spread. Therefore, there’s absolutely no doubt about how efficient this method is. It is just important to know how to use it properly and at the right moment.

The monetary value of each pip is dependent on three factors: the exchange rate, the trade value, and the second currency in the pair being traded. Taking a course in forex such as this from easyMarkets will help you better understand how currency pairs work. We cannot stress how important it is to go through these courses since you can get a high-detail explanation of all the relevant processes and approaches including this one.

Whether you made a profit or loss at the end of the day depends on the movement of the exchange rate of a currency pair. A trader who buys the USD/CAD pair will profit if the value of the US dollar goes up relative to the Canadian dollar. While it may seem like these movements are not as common, we beg to differ. By using this method, traders can spot all the movements that are happening practically every day. So, the potential for amassing a significant amount of money as a result of using this method is a possibility.

What is a spread?

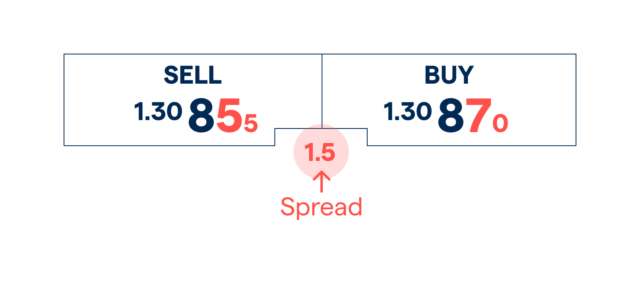

A spread or bid-ask spread is the difference between buying and selling prices. It is essentially the highest price that a buyer is willing to pay for an underlying asset and the lowest price a seller is willing to receive. It is traditionally represented in pips or price interest points. It means that spread is interconnected with the pip, and you cannot expect one of them to work without collaboration with another one.

Like equity markets, forex quotes also include bid and ask prices. In forex, a spread refers to the price at which the market maker or broker is willing to buy base currency in exchange for the counter currency. Ask price, on the other hand, refers to the price at which the broker is willing to exchange base currency for the counter currency. You can see that there are some similarities with the previous term we’ve been explaining, but it’s not completely the same.

According to HowToTrade, the bid-ask spread is the difference between the price at which a market maker buys and sells a currency. The bid price is quoted when a customer starts a sell trade with the broker and the asking price is quoted when the customer starts a buy trade. The benefits of this approach are not immediate but that doesn’t mean you’re going to be waiting for too long before you can reap these financial benefits.

For example, a US-based investor buys euros and the bid-ask price on the broker’s website is $1.1300/1.1350. The investor will have to pay the asking price of $1.1350 to start a buy trade. If the investor sells the euros back to the broker, they will get the bid price of $1.1300 per euro provided that the exchange rate remains constant. Due to the exchange rate’s bid-ask spread, the trade will cost the investor $0.0050.

Spreads are affected by many factors, such as time of day, market uncertainty, market liquidity and volatility. Taking all of these elements into calculation is not always easy. That’s why making any sort of prediction is not as simple as some would say. They are not right in most situations, as you can presume. You need to invest a lot of time calculating these and even using software to help you with this.

The Bottom Line

Pips and spreads are invaluable methods for every trader out there. They represent a powerful tool that can help you get the upper hand in numerous situations. You just need to understand them and know how to use them properly. We are sure this insight of ours will provide that much-needed help in your future endeavors.