If you’ve heard of technical analysis, or TA, before, it’s easy to believe that it’s not relevant to you. There are so many myths floating around, saying it doesn’t work for most stock trading, and that it is not accurate. There are people out there who say that in fact, TA is the best thing for understanding the market. What is the truth? Let’s uncover it by debunking the most popular TA myths.

TA Is Only For Short Term Or Day Trading

This is the myth you’ve probably heard most often. Detractors or TAs say that it’s only appropriate for computer-driven trading, such as short-term trading and day trading. Otherwise, it doesn’t hold much value.

You’ll be surprised to know that TA was in use long before computers were invented. Also, some of the first people using TA were long-term investors and traders. Because of this, TA can be used on a long-term scale, not just for days and weeks.

TA Doesn’t Have A Great Success Rate

Many traders have put off the idea of using TA because they believe that it has a low success rate. However, this is not true.

When you do research into the most successful market traders out there, you’ll see that they often use TA to track the markets and decide how they can profit from them. It’s one of many tools that can be used to be successful for yourself.

TA Is Only For Individual Traders

Another common myth is that TA is just for individual traders. A lot of individual traders are indeed successful using TA, it’s not just for them.

You’ll see that a lot of hedge funds and investment banks are using TA quite often as well. Investment banks, in particular, now employ whole teams, who are dedicated to using TA in their work. High-frequency trading is highly dependent on TA too, especially when dealing with high volumes of stock.

TA Is Easy And Quick To Do

Take a look online and you’ll see people offering courses on how to use TA. They promise that it will be quick and easy, and you’ll get instant success.

Like most things in life, it’s not as easy as that. You can certainly enter the world of trading using simple TA techniques, but you won’t progress further until you do more research. There’s more to TA than you’d think. ‘If you want to take it further, you’ll need to do more research and learning, and that takes time’.

TA Can Provide Precise Price Predictions

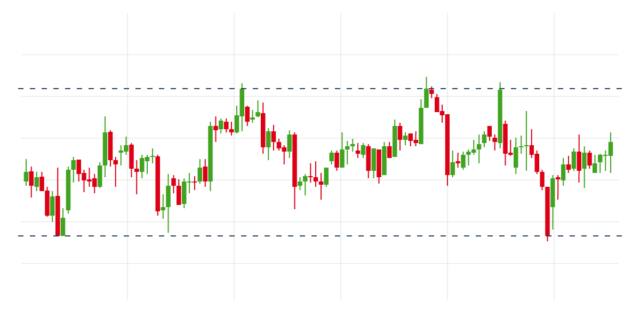

One of the advantages of TA is that you can use it to predict prices, so you can get an idea of how much a certain stock may be. When you first start looking into it, it’s easy to expect that these price predictions will be spot on. For example, you may expect a certain stock to reach $60 in two months.

It’s important to know that TA will give you a predictive range, rather than a precise number. It can’t offer a guarantee, as you don’t know what’s going to happen in the future. Instead, it will offer you the ability to study the probability of a certain price being reached. It doesn’t work all the time, but it’s still a good tool for increasing profits.

Ready-Made TA Software Can Help You Make Money

This is a myth that sounds good, as who doesn’t want to make money easily? There are plenty of sites online offering ready-made TA software, promising to take the hard work out of it for you.

While that looks good, it’s not going to give you the results that you want. They can’t do all the analysis for you, and they can’t guarantee profits.

Stock Markets Always Result In Losses

Without a doubt stock markets are volatile. However, losses are suffered primarily by those who invest without getting their basics right or panic and exit investments following short-term volatility. Stock market investments are a different ballgame that requires patience and a sound understanding of the market dynamics.

It’s also essential to avoid a herd mentality and timing the market. It’s almost impossible to time the market and hence it’s important to remain invested for the long haul. It’s better to seek professional help if required.

Learn more about stock trading computers.

Rising Prices Of Stocks Will Come Down

It’s another common myth of the stock market. If a company has sound fundamentals, it’s not necessary that the price of its stock would come down in case it’s trading at a higher price. Therefore, before buying stock in a company, it’s essential to find out about the company, and its management principles among others. Also, it’s vital not to make a decision based on short-term returns.

You Always Need The Help Of Brokers To Invest

Inadvertently no. If you possess a sound understanding of the market and have the time to track market movements, you can invest on your own. All you need is a Demat and trading account. While the former allows you to hold shares in electronic format, the latter is required for conducting stock trading activities.

Investment In Stock Markets Requires A Lot Of Money

Crores are traded each day in the stock market. However, that doesn’t mean that you need a huge sum of money to kick-start investment in the market. As surprising as it may sound, you can venture into the stock market with as little as Rs. 100.

Note that the issue price per share of tech giant Infosys was Rs. 95 in 1993. Those who had purchased even 100 shares of the firm back then and held it until today have made quite a fortune in all these years.

Conclusion

There are so many myths about technical analysis and stocks floating around, and you need to be sure that you have the facts. With this, you can be sure that you know what TA can and can’t do for you. In many cases, it’s a powerful tool when used correctly.