Millions of people utilize credit cards every day. While it can serve as a helping hand to boost your buying power and help you overcome urgent monetary difficulties, credit card debt is a significant problem among American consumers these days. Those who can’t afford to repay the balance each month often accumulate debt while their credit score drops, payments get missed, and interest increases.

Should you use teen credit cards? Should college students have this lending option? Keep on reading to find out the answers.

Teen Financial Literacy

Credit history is one of the leading factors that describe your creditworthiness as a potential borrower. Once you graduate you will land a job, rent an apartment, get insurance, etc. Each of these milestones is tied to your credit as financial institutions, recruiters, landlords, and even some telephone and cable providers will definitely check your credit. Credit history has a long-term impact so financial literacy for high school students should certainly be taught.

It’s really important to educate young people on how their credit works and how it can influence their life and financial decisions. Also, it’s essential to teach teens and students how debt generally affects them, how credit cards work, what they can be used for, and why it’s necessary to pay the debt on time.

There are lots of resources like FitMyMoney where financial literacy activities for high school students and adults can be found. Learning how to manage personal finances and avoid the vicious debt cycle will help your children keep track of their expenses and feel the responsibility.

Consumer Credit Card Debt

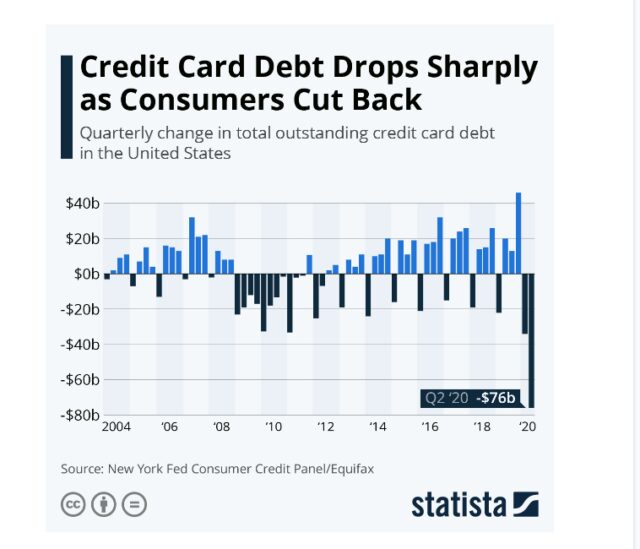

According to the recent report on Key Figures Behind America’s Consumer Debt, the usage of credit cards dropped in 2020 due to the pandemic. Credit-card loans were $820 billion in the fourth quarter of 2020 compared to $930 billion a year earlier. It was the first significant drop in a major consumer debt category in seven years.

Many people used to opt for this lending solution if they couldn’t cover urgent medical expenses or pay the bills. Generally, credit card usage meant a greater buying power among American consumers.

This option helped thousands of families and individuals prevent financial disaster, while teen credit cards have also become popular. Over 191 million Americans have credit cards today. Every holder owns a minimum of 2.7 cards, and the average household credit card debt is $5,315.

Teen Credit Cards: Should You Use Them?

In spite of some downsides of credit card debt, this lending option offers many benefits. High school and college students may start using credit cards for several purposes. The obvious reason is to establish a credit history.

We’ve just talked about the importance of building your credit. So, young students can start establishing their credit by getting a credit card. It will help them not only learn financial responsibility and independence but also help them build credit.

Another benefit of using credit cards for teens is that their credit history will be longer. You may know that this factor is also significant for your future financial decisions and borrowing solutions.

The longer your credit history is, the easier it is to apply for various lending options and get approved. Thus, your FICO rating can improve if you establish a line of credit sooner. Besides, credit cards boost your purchasing power allowing you to fund your urgent cash needs.

If teens and college students start using credit cards at their age, they will most likely:

- Be able to rent an apartment

- Qualify for mortgages and personal loans

- Get reasonable interest rates on various loans

- Land a well-paid job

- Receive lower car and homeowners insurance premiums

Many teens may benefit from having a credit card in college and even high school. Remember that young children don’t have their own emergency funds so having their own credit card may help them learn how to manage personal finances and cover urgent expenses.

A credit card will serve as a safety net for them but also teach them to return the debt on time. Parents should consider opening a teen credit card if they want to teach them financial literacy and responsibility.

However, you should think about the following items before you make this decision:

- You should monitor the teen’s spending as a parent

- You should check the monthly payments of your teen

- Is your teen responsible in terms of personal funds?

- You should discuss the interest rates with your teen, as well as financial choices and their consequences

To Have Or Not to Have

Do you want your teenager to improve financial literacy, learn responsibility, and boost spending habits? Then it’s a good decision to open him or her a credit card. In any case, parents should decide whether their child is mature enough to know all the benefits and drawbacks of credit card usage.

Talk about the pros and cons of having a credit card, how it works, and what spending categories may be funded with it. Take some time to educate your child about this financial option and the reasons why it’s significant to own a credit card.

Review several cards and their rewards to find the most suitable option tailored to the current monetary needs of your teen. Take some time to help your child make the first purchase with a credit card and walk them through the first monthly payment. This way they will understand the whole process and be prepared.

In conclusion, parents should decide if their children are ready for having their own credit cards. Prepare your teen for using a card and educate your high school students so that he or she knows why it’s important to establish credit from an early age. Discuss the advantages and downsides of credit card usage and explain to them how to be a responsible holder and avoid debt.