Success and growth depend on the right payment gateway partner. Integrating payments into software or apps appeals to many business owners. It’s possible to securely process online payments and grow the clientele nationally or internationally.

Learn about white-label payment gateways, their quirks, and how to choose a partner.

White Label Payment Gateways

First, define the term. White-label payment gateways enable companies to accept payments under their own brand names while making use of existing third-party infrastructure.. A company logo is a customized solution.

Who Needs a White Payment Gateway and How?

Such technology is essential for every company or brand, since it offers several benefits, including but not limited to:

- Brand recognition;

- Flexibility;

- Cost-effectiveness;

- Customer satisfaction.

White-label payment gateways build customer loyalty and trust. When the payment process takes them to a different website, many people feel uneasy. They start doubting. The technology allows business owners to brand their services.

Reputation could improve. This offers many benefits and ways to grow a business without having to build a payment gateway.

Moreover, businesses that offer fintech services can take advantage of white-label payment gateways to enhance their offerings. For instance, companies like SDK Finance specialize in providing comprehensive fintech development services.

By integrating their solutions with a white-label payment gateway, fintech companies can provide a seamless and secure payment experience for their clients while focusing on their core expertise.

Online stores, software, gaming platforms, and system providers use such services. Online payment companies should get them. Starting is easy. Select a reliable partner and receive the desired services.

Market’s Best Solutions

A business owner must realize that not all white label payment gateway partners are created equally when choosing one. Let’s look at some popular, high-quality companies.

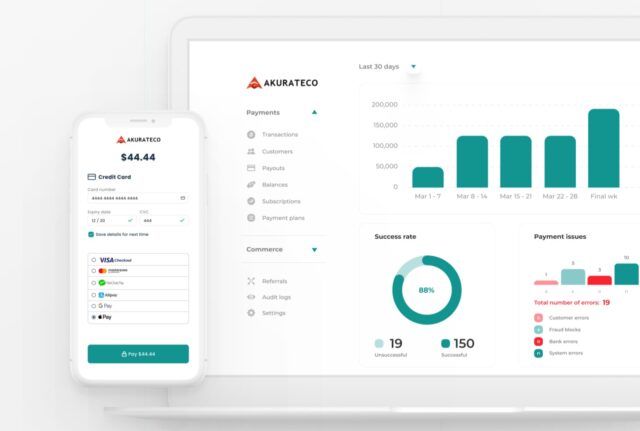

Akurateco

This website provides white-label payment platforms to various companies. Fraud protection, high-end invoicing systems, data analysis, management tools, and white-label payment gateways are offered by the Amsterdam-based firm. Each customer’s payment gateway is customized.

Furthermore, Akurateco’s management tools empower organizations with the tools they need to effectively oversee and control their payment operations. One of the standout features of Akurateco’s offerings is their white-label payment gateways, which can be fully customized to match the branding and requirements of each individual customer.

This level of personalization ensures a seamless and consistent payment experience for end-users while reinforcing the client’s brand identity. Whether it’s a small startup or a large enterprise, Akurateco’s payment solutions are designed to scale and adapt to the evolving needs of businesses in today’s digital landscape.

BitHide

BitHide provides a white label cryptocurrency payment gateway for your product. First, all payments are anonymous. With BitHide, you can easily integrate secure and convenient cryptocurrency payment options into your platform.

First and foremost, BitHide ensures complete anonymity for all transactions, allowing users to maintain their privacy while making payments. Additionally, BitHide’s advanced transaction control mechanisms guarantee the security and reliability of every payment processed through its gateway.

Furthermore, BitHide’s comprehensive administrative features empower you to manage and monitor transactions with ease, making it a trusted and preferred choice in the market.

With BitHide you can:

- Process cryptocurrency for clients with BitHide.

- Accept cryptocurrency from customers.

- Separate suspicious transactions if needed.

- Make your solution corporate standard.

- Own and store your data.

- Use BitHide’s anonymity and administrative features.

- Manage multiple wallets regardless of merchant count.

Ikajo

Over 100 payment methods and multiple integration options are available. Ikajo accepts main card payment types and alternative options and supports over 100 payment methods and 150 currencies. Moreover, Ikajo goes beyond just providing payment options.

Their comprehensive payment gateway solutions offer advanced features and robust security measures. With Ikajo, you can rest assured that every transaction is protected with state-of-the-art encryption technology, minimizing the risk of fraud and ensuring the safety of sensitive customer data.

Furthermore, Ikajo’s user-friendly interface and seamless integration options make it easy for businesses to incorporate their payment gateway into existing platforms or websites. Their dedicated technical support team is always available to assist with the integration process, ensuring a smooth and hassle-free experience.

In addition to its extensive payment method offerings, Ikajo also provides detailed analytics and reporting tools. These insights allow you to monitor transaction trends, identify potential areas for growth, and optimize your payment processes to maximize revenue.

Whether you operate a small online store or a large multinational e-commerce platform, Ikajo’s versatile payment solutions and customer-centric approach can help streamline your payment processes, enhance customer satisfaction, and drive business growth.

Avoid security concerns. Over 100 parameters are checked real-time for each payment. For convenience, one-time and recurring payments have different verification scenarios.

PayPipes

PayPipes provides a technological solution that conforms to the look and feel of the payment gateway, making it simple for clients to make purchases using any supported payment method and in any supported countries.

Financial experts may assist business account holders via the payment gateway system. Not limited by geographical boundaries, PayPipes supports transactions in multiple countries, allowing businesses to expand their global reach and cater to a diverse customer base. Whether your customers are in Europe, North America, Asia, or anywhere else, PayPipes ensures a consistent and reliable payment experience.

Additionally, PayPipes provides valuable support from financial experts for business account holders. With their expertise in payment gateway systems, these professionals can offer guidance and assistance to optimize your payment processes and enhance financial operations.

Whether you have questions about risk management, fraud prevention, or maximizing revenue, PayPipes’ knowledgeable team is there to support your business every step of the way.

With PayPipes as your payment gateway solution, you can provide a seamless and secure payment experience for your customers, expand your business globally, and benefit from the expertise of financial professionals who understand the intricacies of payment processing.

BlueSnap

BlueSnap develops white-label software, cloud-based payment processing systems, transaction management tools, and anti-money laundering compliance verification services for payment service providers, acquiring banks, and other payment businesses.

From simple payment acceptance software developers to global marketers. BlueSnap’s software, tools, and services help payment companies of all sizes process and secure online merchant transactions.

BlueSnap’s white-label software allows payment companies to customize and brand the payment processing systems according to their requirements, ensuring a consistent and cohesive user interface that aligns with their brand identity.

By leveraging BlueSnap’s cloud-based infrastructure, businesses can benefit from scalable and reliable payment processing capabilities, enabling them to handle high transaction volumes and meet the demands of a rapidly growing customer base.

Conclusion

White-label payment gateways give all kinds of businesses many features. It distinguishes companies and simplifies customer payments. Offering such services is another way to promote a brand, increase recognition, and improve customer experience.